If you’re suffering from a lower credit score because of past financial mistakes or other financial mistakes, a pay for delete letter could be an important game changer. This powerful tool lets you bargain with debt collectors to eliminate negative information off your credit report, in exchange for a payment.

However, drafting an effective pay for delete letter is a challenge particularly if you’re not familiar with the procedure. This is why we’ve put together an assortment of pay for delete letter template along with expert advice that will help you get through the procedure with confidence. If you’re trying to improve your credit score or want to manage your finances Our templates will help you start on the road toward financial success.

What is a “pay for delete letter?

Let’s say you discover that you have poor credit due to there are negative marks on your credit report resulting from an unpaid credit card. One of the choices is to contact the debt collector to erase any negative marks from your credit report, in exchange for the payment of part or all the debt. This is known as “Pay for Delete” or “Pay for Deletion’ and it’s a useful method to pay off your outstanding debts.

Collection accounts may remain in your credit file for as long as seven years. Removing the negative information from your credit file will eventually boost your score on credit. It’s important to note that the most recent credit scoring models such as FICO 9 and VantageScore 3.0 do not consider collections that are paid.

Writing an order to delete your pay is a viable option as it’s relatively simple to write. Debt collectors typically purchase consumer debt at a price of pennies per dollar, which is less than ten cents on recent debts. If they can earn 25 cents on the dollar, they’ve earned money.

Pay for the Delete in Three Easy Steps

Three steps are required that can be taken to convince a debt collector to eliminate collections from their accounts with an agreement to pay for deletion:

- Find out who is responsible for the debt. Most likely, they’ll contact you. If they don’t the credit bureau will include the credit report. If not, contact the company who initially provided you with services or the money you borrowed They should have their own records on your file.

- Send the collection agency send a letter of payment. Consider it as a simple business arrangement If you pay a portion or all the debt they claim you have to them, they will take the negative information off your credit report. Ask for the pay for delete agreement in writing. There are some samples of pay for delete letters below. Be aware that these are just examples of letters. Always write your own words.

- If the creditor accepts the agreement in writing keep the letter in file and pay the agreed amount.

If your credit report shows a negative marks, you have contact the collection company to remind them of the bargain. If this isn’t working, seek out a lawyer or credit repair service.

How does a pay for delete letter work?

First, it’s important to remember that if you offer to pay off a debt to have an account for collection or a judgement taken off your credit report does not mean you’re granting the debt to someone else.

A pay for delete notice will let a collector know that you are willing to pay off any amount that a collection agency claims you are owed.

As a condition, you’re requesting an agreement signed by the person who will eliminate offending negative items, such as the collection of a credit card or judgment against you on your credit report.

Pay for the Delete Letter Success

Collection agencies for debt are not required to agree with your terms. The majority of lenders will inform you it’s impossible since they don’t want the trouble of updating your credit score to the credit report agencies.

Collection agencies for debt like Transworld Systems and Credit Collection Services are primarily interested in making money. If you remain firm you’ll likely be able to communicate with someone who knows what a pay-for-delete agreement is. They may be willing to cooperate with you, particularly when it’s a way for them to earn some money.

Be aware that, when you’re working on your pay for deletion process, there may be other deadlines that you need to take into consideration, like the 30-day time limit to validate debt.

Select a pay for delete letter template below, and alter it to meet your specific needs. If this sounds complicated and, often, it is, you should consider using a credit repair service to take the stress out of this process. They can assist you in improving your credit score by resolving incorrect information on your credit report.

Tips to Send Your Pay for Delete Letter

- It’s not worthwhile to send a”pay for deletion” letter to settle an old credit that’s not in your credit report. It’s the same for a debt that will disappear from your credit report in two or three years. If the debt is that old it will not affect your credit history or credit score. It is usually better to let it go and let it fade away.

- Make sure you keep a copy of the letter for your records. Get in a habit of completing this process for any correspondence with collectors, creditors as well as credit bureaus.

- You can send your pay for deletion letters and follow-up payment using Certified Return Receipt of Mail. So, you’ll always be able to prove that they received the pay for delete letter and the payment.

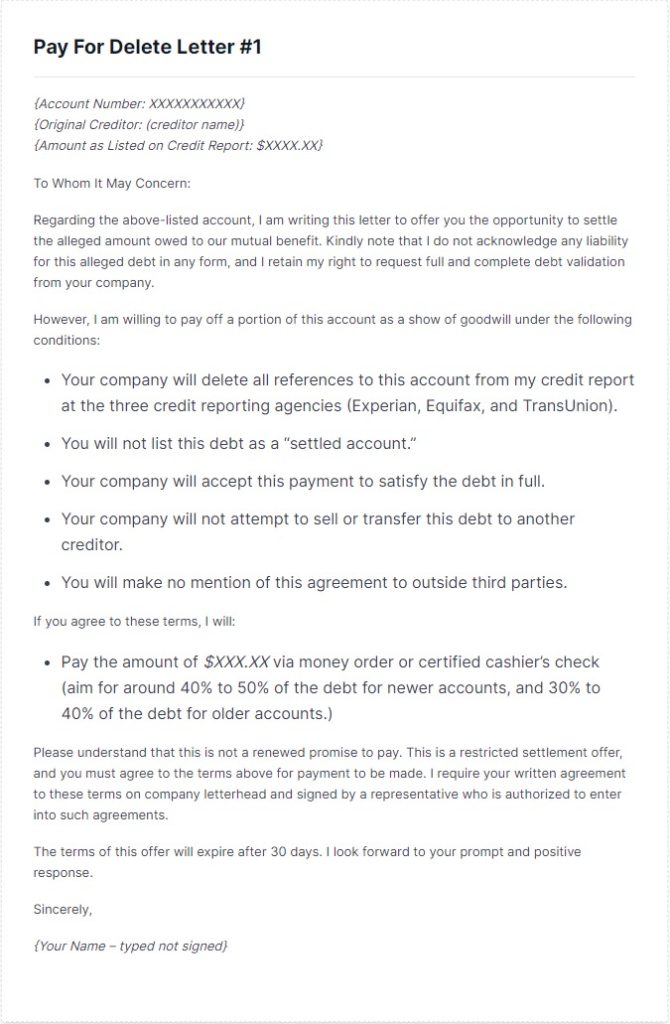

Sample Pay For Delete Letter Template 1

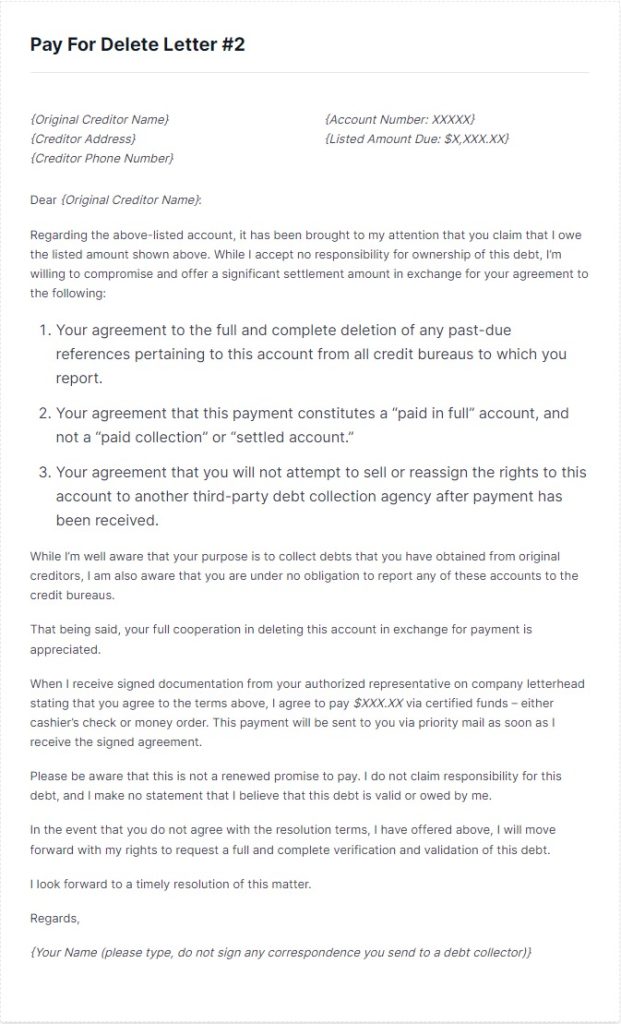

Sample Pay For Delete Letter Template 2

What should you do if your pay to delete letter is refused?

Unfortunately letters that request payment for deletion aren’t always successful. Sometimes, a collection company will not cooperate. If the collection agency denies your request to delete your pay however, you have other options to have the account off your credit report.

The Fair Credit Reporting Act (FCRA) permits you to contest recoveries, charge offs late payments, as well as other marks that are negative on your credit reports through the three credit bureaus that are major. They will then initiate an investigation in conjunction with the collection agency. If they are unable to prove that the credit report is true or they don’t respond within 30 days, they have to erase the negative information from your credit report.

Another alternative is debt validation, according to the Fair Debt Collection Practices Act (FDCPA). The debt collection company can be sent an official confirmation letter. If they are unable to verify the debt, they have to delete all negative data from your credit report.

Can I send a pay for delete letter to the original creditor instead of the collection agency?

The majority of credit unions and banks do not typically allow pay for letters to delete. They are best suited for small collections accounts.

To eliminate any other credit-related negatives from your report You’re probably better off by submitting the letters of dispute with credit.