In many cases, when there is a debt or money issue tensions can be high which makes us forget that we’re dealing with other people just like us.

The most efficient way to boost your credit score is simply describing your situation and asking for a little of compassion by writing a kind letter.

What’s a Goodwill Letter?

A letter of goodwill is one type of letter that an individual borrower could send to a lender asking for the correction of their credit report. The letter asks that the lender erase any negative data from the borrower’s credit file or to alter the conditions of the loan.

Let’s say, for instance, you have an negative mark on your credit report with an account that hasn’t been reported to a collection agency. If your missed payment is current, you can ask your creditor for contact with the three bureaus of credit to take the late payment off your credit report.

Creditors aren’t obliged to delete the correct information from your credit file. But, certain companies wish to please their customers. Therefore it is in their best interest to make sure you stay as a client.

Do the Goodwill Letter work?

Absolutely. Many people have succeeded in using goodwill letters to erase the negative credit report items like late payments or other negatives. But there’s no guarantee the goodwill letter will eliminate the late payment from your credit report.

In fact some banks have even stated publically that they do not accept goodwill letters. For instance, Bank of America says on their website that they are “required to report complete and accurate information” which is why they will not honor requests for adjustments to goodwill.

If your bank is feeling like this, perhaps it’s time to move to one which values your business more? But, you’ve got nothing to risk by writing goodwill letters other than some minutes of your time.

When to use a Goodwill Letter

There are many situations where you stand the best chance of getting an affirmative response from your lender.

For instance, suppose you attempted to pay your bill on time, but you encountered an error in the system (especially when it occurred at the expense of the creditor). In this case you’re an ideal candidate for an adjustment to your goodwill. Perhaps their website was not working or their phone was occupied for an unreasonable amount of period of time.

You can also consider an excuse letter from goodwill when your autopay hasn’t worked for any reason. Even the bank account you have had unsufficient funds, you can certainly inquire and provide the reason the reason why your account was not able to pay. Perhaps the check was more difficult to be deposited than you anticipated or an unexpected expense arise.

If you have did not make a payment but you are otherwise a great customer, making punctual payments, a goodwill note can be used to ask for removal.

In the end, you’re still an active customer. Most creditors like the fact that they rely on customers just like you to help keep their business running.

How to write a Goodwill Letter

When writing a letter of goodwill it is essential to clearly state the problem and the reason of the request. Include any information about your financial situation at present that may be relevant. Be courteous and professional while writing your letter.

- Be courteous. Try to imagine yourself in the shoes of your company and inquire about the way you’d prefer to be treated. Remember that the company given you a service, and thank them for it.

- Recognize the fault for the late payment and provide the reasons that hindered you from making the payments.

- If you require a great credit score due to a particular reason, like a car loan or mortgage be sure to mention it.

- Be courteous. Reward them for their time and help with any questions they may have.

Utilizing goodwill letter templates Many users have managed late payment, missed payments and other marks from their credit report removed. You stand a good chance of achieving the same thing if your credit report is no longer in arrears. This is, as long as the debt hasn’t been transferred to an agency for collection.

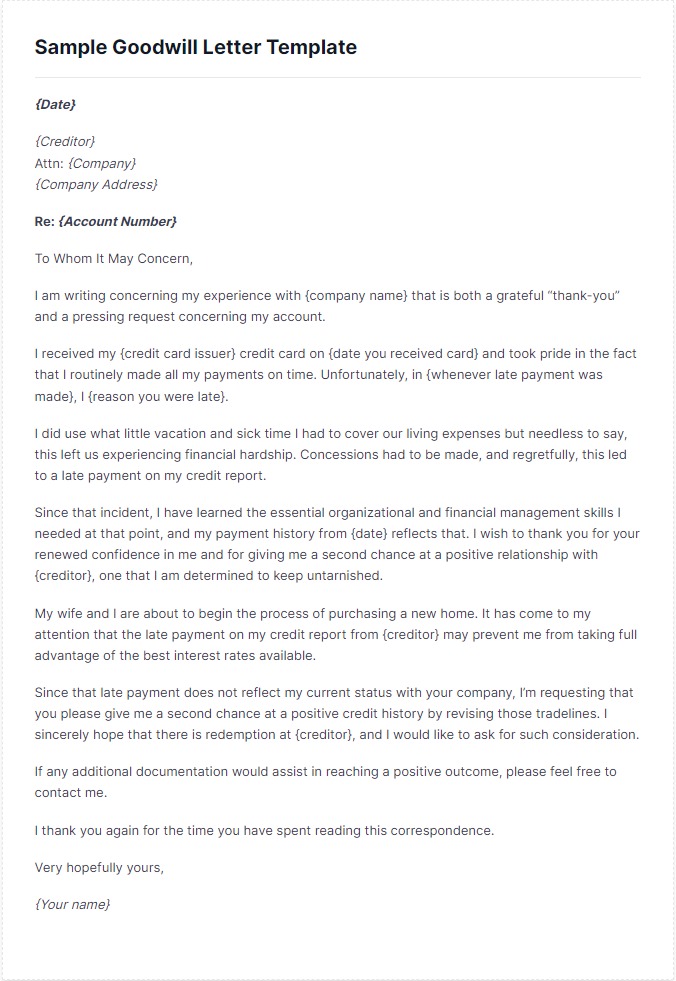

Below is a sample goodwill letters template designed to erase any late payment from your credit history.

Goodwill Letter Template

Note: This goodwill letter template is not required to be used with an issuer of credit cards. You can use it for any negative credit accounts on your credit report. However, you may want to dispute the account with the credit bureaus before attempting a goodwill letter.

What makes a convincing goodwill letter?

When you receive a goodwill letter the creditor will take into consideration the length of time you’ve been an customer. The chances are higher when you have a long-term relationship and have paid punctually. However, it might not be as straightforward for new clients or anyone who has a history of late payments.

It’s also more likely that you get the debt removed from your credit history if it occurred in the past. It’s because you’ve had enough time to establish that it was an incident that happened once and not an ongoing financial problem.

If you’ve previously requested an adjustment to your goodwill by the same creditor particularly in the past two years the creditor is less likely to take the late payment off.

It is crucial to get the attention of the lender by writing an emotional appeal. You must create your goodwill letters as persuasive as you can in order in order to convince them to take positive action.

Good Reasons For Writing a Goodwill Letter

Here are some additional good reasons for missing or being late with payments that you can mention in your letter of goodwill adjustment.

Being Laid Off

If you’ve been let go at work and it’s had an impact on your financial situation, you might want to mention in the letter you write to your boss.

The letters will be more convincing if you can include any dependents you had to look after in the tough times you faced.

A Recent Divorce

If you’ve been through divorce, you’re aware that it can be extremely stressful. It could be a bad effect on your financial situation. It is something you might be able to include in the letter you write if it affected your ability to pay for your expenses.

A Birth or Death in the Family

Both of these are major life events that may come with financial strain. Sometimes, they happen suddenly. Creditors are also people and they’re able to understand what you’ve been through.

A Recent Illness

If you or someone close to you has recently been admitted to hospital you are aware of how tiring and draining financially it can be. Medical expenses can derail your finances and make it difficult to pay the financial obligations you have. It’s something that you could include in the letter you write if it’s happened to you. it.

A Recent Change

Have you recently relocated? If you’ve relocated to another city or across the globe, you’re aware that it can be a stressful experience. Your mail may not be sent to the new address. It is something that you could explain in the letter you send to your creditors.

After You Sending a Goodwill Letter

Once your goodwill note is delivered to you and you’ve received it, there’s nothing more to do except wait. You may hear from your creditor as short as a couple of weeks which is a great scenario. However, it might take longer than that and some creditors may not even respond.

You can always contact customer service to inquire whether they have received your request after several months of waiting. You can assess how strong the case you have made by looking over some of the basic details about your account.

If you’re not having success with your goodwill letters or if you’ve got a lot of negative items on your credit report, it’s an option to contact some credit repair companies for assistance.

FAQs

What should I put in my goodwill letter?

Include the following information in your letter of goodwill the date of the request and the name of the lender and account number and the negative information you’d like to be removed, as well as any pertinent details regarding your current financial situation.

How long should a goodwill letter be?

The letter of goodwill should be short and concise typically, not more than one page. The aim is to clearly convey your message without overloading the reader with unnecessary information.

What are the chances of a goodwill letter being successful?

The effectiveness of the goodwill adjustment letter is dependent on the policy of the lender. Certain lenders might be more inclined to collaborate with borrowers than other.

How long will it take for a goodwill letter be processed?

The time required to process a goodwill request may differ based upon the lender. It can generally take between 30 and 60 days for the lender to look over the request and decide.

Are there any other options to help improve my credit score?

In the same way as goodwill letters, there are a variety of options available to aid in to improve your credit score. These options include paying off any outstanding debts, disputing any errors on your credit report, and making on-time payments. Take a look at our DIY credit repair guide for additional options to improve your credit.

What happens if the lender denies my request?

If the lender refuses the request, you might have to consider other alternatives. Based on the circumstances you may be able contest the late payment to the credit bureaus by submitting the dispute letter. In reality, credit dispute letters are usually used to contest things that appear to be incorrect.