A mistake in your credit report could result through higher interest rates as well as missed opportunities. But, with the proper tools at your disposal making corrections much easier. Explore our guide to teach you how to use a credit dispute letter help you resolve those discrepancies effectively.

What’s a credit dispute letter?

If you notice inaccuracies, or unreliable information on your credit report You have the right to contest the report. To do this, you must submit a credit dispute form to one of the three credit bureaus.

If credit reporting agencies are notified of complaints they are required under federal law, to examine the issue. They must confirm the details within 30 to 45 days and rectify it, or erase the information from your credit file. While letters to dispute credit are usually addressed to credit bureaus, you could also send letters to the original creditor to address your concerns.

Credit Dispute Letter Template & Step-by-Step Guide

If written properly If written correctly, a credit dispute letter is highly effective in removing negative entries from your credit report and fixing credit problems. If you decide to go with the DIY approach or employ a professional you will see positive results when you follow the procedure.

To assist, we’ve provided the credit dispute letter template below that you can copy your letter on. We’ve created a step-by-step guide to help you create a credit dispute letter. We’ll also teach you how to maximize your chances of success.

Perhaps you’ve been the victim of identity theft or perhaps your credit card was stolen. Perhaps you’ve just noticed errors that your creditor has made. Whatever the reason, it’s your right under the law to contest the errors on your credit reports.

You have the right to make sure that the information about you in your credit report is honest and accurate. It is important to approach it in a way that is fair and ethical to ensure that you don’t miss the chance to boost your credit score by using this method.

What items You can contest on credit report?

Any information that an agency for credit is reporting in your credit report could be challenged. This can include, but isn’t restricted to the following things:

- personal information

- credit inquiries

- charge offs

- collections

- late payments

- bankruptcies

- foreclosures

- repossessions

- tax liens

- judgments

You receive an free credit report from every one of the big credit bureaus each 12 months. After you’ve received your credit reports take the time to scrutinize them carefully. Check for any bad accounts that might be erroneous or untrue.

Be careful to ensure that you don’t make a mistake by disputing positive items. Once an item has been removed it’s almost impossible to reinstate them to your credit report.

If you’re unsure if an item is positive or negative but you’re not ready to make a claim yet. Be sure you are aware of the information being listed on your credit report prior to beginning the dispute process.

Sending Credit Dispute Letters to Credit Bureaus

It’s not necessary to submit any evidence when submitting a dispute since the burden of proof rests upon the credit bureau. If you do have any evidence you think will aid your case, include it in the dispute notice for credit reports.

It could be an email from a debt collector requesting an amount you have already paid. It could be proof that you paid off any outstanding debts or an email from the creditor stating that you have agreed to an agreement. If you are providing copies of the above information, make sure to erase sensitive information such as your Social Security number before sending it to the creditor.

Once you’ve got everything together, you’re now ready to send a dispute on your credit report letter. If you’re prepared and prepared, you stand a better chance of success taking some time and gather your documents. Your letter must note the mistake in your credit report. You should also note that you’ve marked the dispute in the attached copy to be used as a reference.

It is essential to request for the item to be removed. Be aware that the letter must be as specific as it is to get the best results.

How to Write a Dispute Letter

When you write your dispute letter on your credit report to the credit bureau, be sure to follow these simple guidelines:

- In the majority of instances, it’s not necessary to talk about laws or procedures, court rulings or threaten lawsuits etc. Credit reporting agencies are aware of the laws.

- In the same way, be considerate. The use of abusive language isn’t helping and can cause harm. You’re not likely to scare people into taking action.

- Include copies of any information that backs your claims, but keep in mind that anything you provide to an agency for credit can be used against you. Don’t submit original documents. Be cautious when you’re sending this document. If you aren’t certain, don’t send it.

- Send copies of the letter disputing Make copies of the dispute letter, but always keep the originals for your records.

- It is important to specify which item or items you’d like to address in your credit report. There is no need to inform the credit bureau what you’re contesting. The burden of proof lies on them.

- A credit bureau isn’t obliged to look into requests that appear to be unfounded. Be sure your letter is clear and concise. It is a good idea to check the letter’s spelling before sending it.

NOTE: Always include a photocopy of your driver’s license, state-issued ID, or U.S. passport and a copy of your Social Security card, pay stub, W-2, or a recent utility bill. Only 2 forms of ID are required.

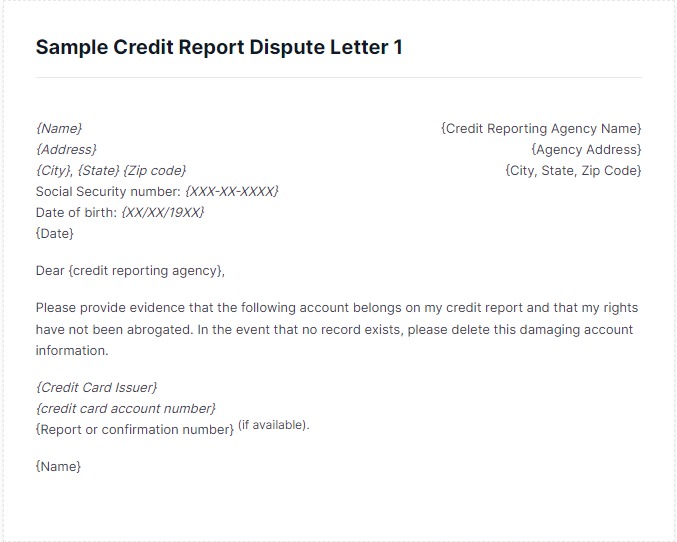

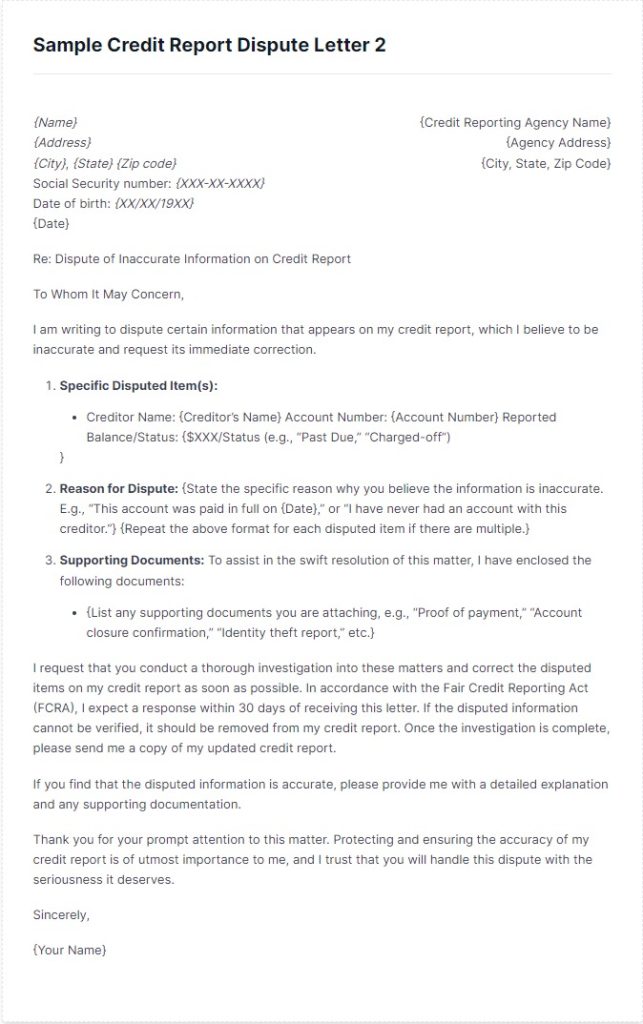

Sample Credit Report Dispute Letters

Two sample letters are provided to use when contesting a credit card account with an agency for credit reporting. These templates are ideal for submitting credit dispute letters to Equifax, Experian, or TransUnion. Remember that they’re only examples. They’re designed to provide you with an idea of how an actual credit report dispute letters should be like and what it should contain.

Personalize your message for your specific situation. Keep it brief and concise. It is always ideal to write your statement with your own words, and to know what you’re doing. If you aren’t sure of the right way to proceed it’s possible to increase the severity of your credit score.

Equifax Dispute Address

Equifax

P.O. Box 740241

Atlanta, GA 30374-0241

Experian Dispute Address

Experian

2220 Ritchey St.

Santa Ana, CA 92705

TransUnion Dispute Address

TransUnion

P.O. Box 1000

Chester, PA 19022

You should also send your letter via certified mail with “return receipt requested.” This serves as evidence that the credit bureau has received your letter and starts the 30-day clock for them to investigate the dispute.

Disputing items on your Credit Report Online

Equifax, TransUnion and Experian all provide online dispute forms available on their sites. We strongly recommend against submitting online disputes since it’s not as efficient.

The process of submitting your dispute with your credit report online restricts your rights, and gives you less control and allows you to do exactly what the credit agencies want you do. It’s playing right into their hands by giving them a quick way to get your dispute resolved online.

There is a chance that you will be able to remove negative things by arguing them online. But, this isn’t the best method. Why? The most important reason is because you could accidentally waive certain rights you have under the Fair Credit Reporting Act when you decide to make a claim online.

Disputing items on your Credit Report by phone

You can settle your disputes on the phone, but it’s not a good idea. It’s nearly identical to arguing online since there’s no evidence of your actions.

The best method to eliminate the negatives from your credit report is to write an official letter. This will help you keep a meticulous record of all the communications that you make and receive.

What happens if it is returned with the status of “verified”?

It’s not uncommon for creditors to be slow when it comes to getting rid of negative items. This is especially true when they’re trying to convince you to pay back the debt that you have already paid in some way. Remember, they must complete the complete inquiry within the first 30 days of receiving the letter.

Sometimes, credit bureaus don’t cooperate with each other. At this moment, you should get in touch with the credit bureaus once more to inform them that they’ve committed a mistake and are in violation of your rights. It could take several letters to get them to eliminate the charge.

If, however, you’ve submitted several letters but the credit bureau refuses to eliminate the account it may be necessary to seek legal assistance. It could be expensive and should be reserved for particularly harmful items. You may also be able to get it done just by writing a note on a letterhead of a lawyer.

You can also make a complaint to the Consumer Financial Protection Bureau if you are not satisfied with the result of the outcome of a credit dispute.

Be Sure To Know What You’re Doing!

You must take care to do this right since getting a mortgage or a car loan even a job may depend on how well you get your credit score in order.

We’ve heard of many people who’ve damaged their credit more difficult (in some cases, much more so) because they weren’t aware of the consequences of their actions.

If you’re not vigilant, you could without knowing it, violate your consumer rights and cause irreparable damage to your credit score by trying to save some dollars making it your own.

Working with the credit bureaus and creditors can be stressful. The constant exchange dealing with them is long and tiring. They aren’t always able to provide the desired result In this cases, follow-up letters are required.

Professional Credit Repair Companies Can Help

As you’ll be able to tell from the detailed directions above, disputing one negative mark on your credit report could require a lot of effort. In the beginning, you’ll need to talk to your creditor.

If that doesn’t work you’ll need to reach out to each credit-reporting agency individually. Because you must send everything using authentic mail to be sure that you do not waive any rights, doing it correctly is still a slow method.

One method to speed up the process and cut down on time is to employ an experienced credit repair firm. They are knowledgeable about credit laws and can manage the procedure on behalf of you in a quick and efficient way.

A credit repair company removes the stress from the process. You can make contact with the company to know the status of your case without having to speak to apprehensive or angry creditors.

FAQs

What exactly is the Fair Credit Reporting Act (FCRA) and why is it vital?

The Fair Credit Reporting Act (FCRA) is an act of the federal government that ensures the fairness, accuracy, and security of information contained in the consumer reports’ files agencies. It safeguards consumers by making sure that credit bureaus provide accurate information and permits contesting and correcting any inaccurate information.

What happens if the same error is found on multiple credit reports?

If the error is found on several credit reports, you’ll need be sure to mail separate dispute letters to each bureau that is reporting the error.

What happens if the original creditor verifies the debt but I still believe it’s inaccurate?

If the original creditor has verified the debt, but you believe that the debt is still incorrect you can ask for verification methods or seek legal assistance. You can also put an explanation of dispute to your credit report.

What happens when I mistakenly dispute a valid item on my credit report?

If you make a mistake and challenge a valid item the credit bureau will inquire and verify the authenticity of the item. Repetition of disputes over valid items could be viewed as a sham, and the bureau may not take note of subsequent disputes.

Why I should not dispute inaccuracies on the internet or by phone?

Disputing incorrect information on the internet or by phone may seem appealing, but it typically restricts your rights and doesn’t provide a written trail which is crucial in the event of a dispute escalating or requiring legal intervention.

Can a credit dispute affect my credit score?

If an issue results in the removal or modification of negative or inaccurate information from your credit report, this may negatively affect the credit score.

Are there any fees associated with sending a credit dispute letter?

The process of sending the letter does not require any charges from credit bureaus. However, if you mail it by certified mail with “return receipt requested,” you’ll need to pay for the postage.

3 Comments