Despite the effect that credit scores can have, many people don’t know their meaning and the way they’re calculated.

Your credit score affects everything you do in ways you might not think of. For instance, having an excellent credit score can lead to lower mortgage rates as well as car loans and certain kinds of insurance, and also lower rates for credit cards.

Some employers also rely on credit scores to make hiring decisions, so having a good credit scores often affects your earnings potential during your entire career.

This guide will go over the fundamentals of understanding what credit scores are and isn’t and how to determine if you have credit that is good or bad and the best ways to increase your current credit scores.

What is a credit score?

For instance your credit union or bank will check your credit score prior to making a decision on whether to approve you for a mortgage. If you’re approved for a mortgage, the rates you are eligible for are directly correlated to your credit score. Higher credit scores translate to lower interest rates, and vice in reverse.

Your credit scores aren’t directly correlated with the amount of money you earn. People with low incomes may have a great credit score, whereas people with a high income are prone to having a low credit score.

Your credit scores aren’t tied to a specific credit card or bank. Credit card issuers and banks do look at your credit scores in order to decide whether to lend you money. However these scores are provided through third-party sources, not by the lenders themselves.

How credit score be calculated?

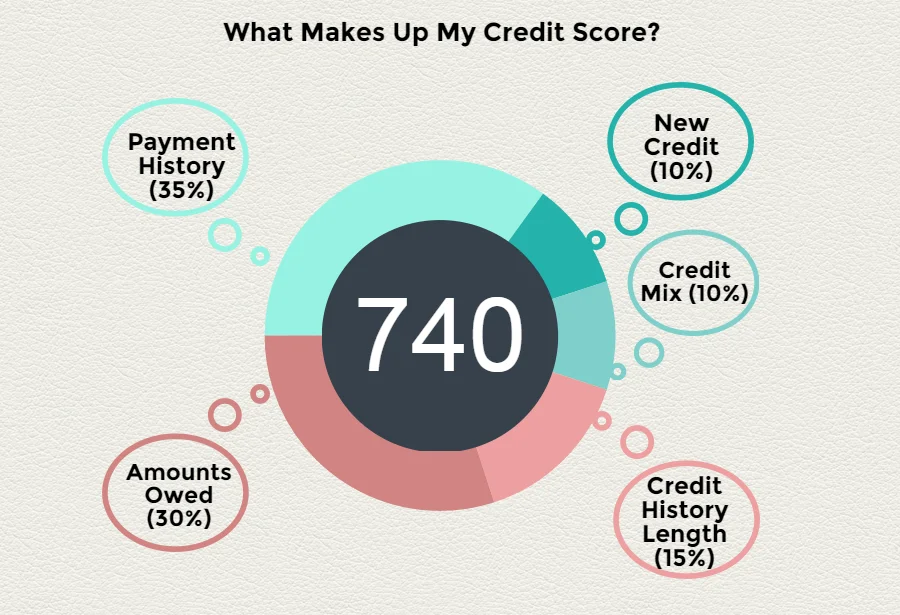

Your credit score is determined by various factors. The way it is calculated:

The Fair Isaac Corporation (FICO) calculates your credit scores using their internal algorithm.

They base their credit scores on information from credit bureaus regarding your financial history and actions as provided by your creditors. The length of your credit history and the amount you owe, your payment history, credit mix and even new credit are all component of the calculations. However the exact formulas FICO employs are kept not disclosed.

How often does credit score change?

Your credit score is continuously fluctuating based on your actions make. It’s normal for it to fluctuate from month to month, or even day-to-day, as your creditors update their information.

To say it differently:

Your creditors provide information about your payment history and financial obligations to credit bureaus.

- Credit scorers take the information from your credit report and other information regarding you to calculate a credit score.

- The credit score is an instrument for “grading” your financial responsibility.

- New lenders then look at the credit score to decide the likelihood that you’ll be able to pay in the near future. The better your credit score will be, the more likely you’ll be able to get approved for credit or loan and also get the most favorable rates.

It’s good to know that there are certain steps you can do to improve your credit score in the near future in the event that they’re not the way you would like them to be now. To know where you stand, you have to be aware of where your credit scores are within the range of possible credit scores.

What are the different credit score ranges?

There are a variety of different credit scoring methods, however FICO scores are the ones lenders utilize the most.

There are a variety of FICO scores used in the auto, mortgage and insurance industries, however the most important thing to keep in mind is that FICO is the main player in the field of credit scores. When your lender mentions getting you a credit score 9 out of 10 times they are speaking about your FICO score.

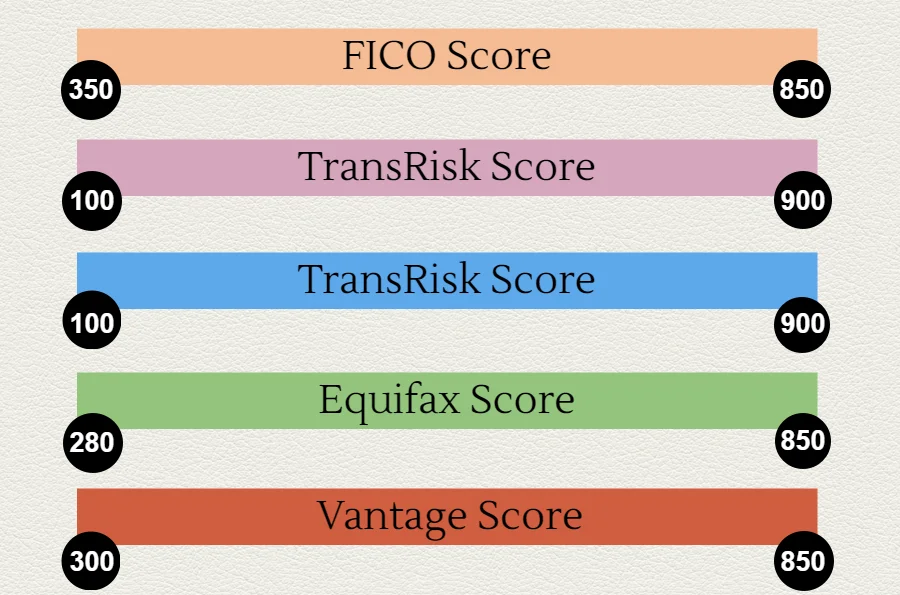

The FICO score range is between 300 and the 850 mark.

Other credit scoring models, and their ranges include:

- Plus Score: PLUS Score Experian created this credit score and it only utilizes the information on your Experian credit report. Creditors don’t use this score. It’s primarily used to inform consumers about the risk they face with their credit. The PLUS score varies between 330 and 830.

- TransRisk Score: as the name implies the score was created by TransUnion. The score is used to determine the risk of opening a new credit account and not your ability to pay your current accounts. TransRisk credit scores vary between 100 to 900.

- Equifax Score: It is an educational tool similar to as the score PLUS. The credit score ranges between 280 and 850.

- VantageScore: The VantageScore is the sole credit scoring system used by lenders. The major credit bureaus developed it in order to compete against the FICO score. The latest version of VantageScore features the same range of credit scores that FICO has: between 300 and 850.

What is considered a great credit score?

A credit score’s status as “good” or “bad” is dependent on the type of credit you’re trying to get and the maximum interest rate that makes you feel satisfied.

or something that is relatively small, such as a personal loan or credit card, there’s a variety of credit scores that can be considered to be good.

Mortgage lenders however typically will require that your FICO score gathered from the three credit bureaus isn’t lower than 640. If you have a credit score of 640 you’ll be facing high interest rates that can add hundreds of dollars mortgage payments.

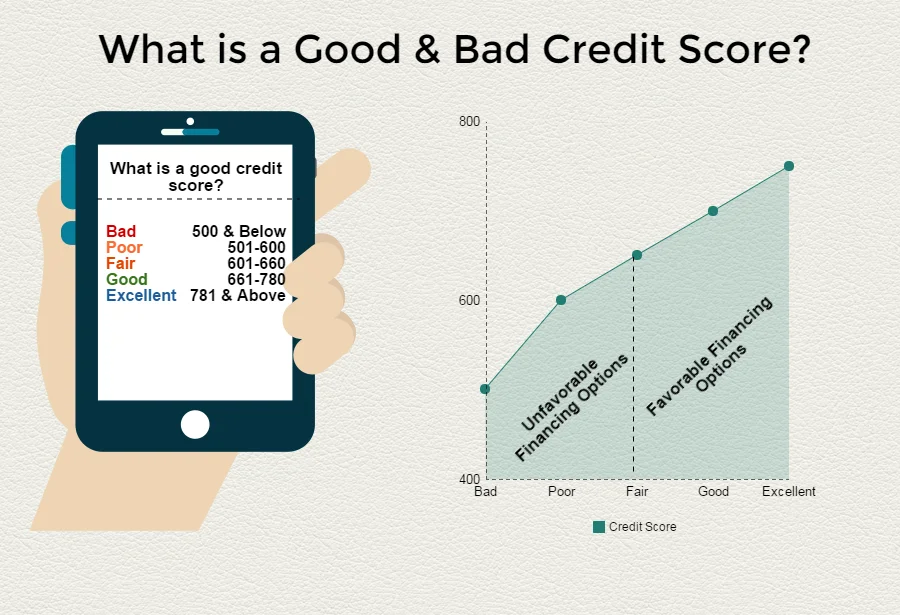

The general guidelines regarding what is a good credit rating against one with a poor credit score are as the following:

- Excellent credit: 781 – 850

- Good credit: 661 – 780

- Fair credit: 601 – 660

- Poor credit: 501 – 600

- Bad credit: 500 and below

Although it’s great to have great credit scores or even a flawless credit score of 850, you’ll probably already be eligible for the best rates on all things that has a credit score of the middle to high 700’s.

If you’re seeking an idea of what credit score you’ll require in different situations Read on.

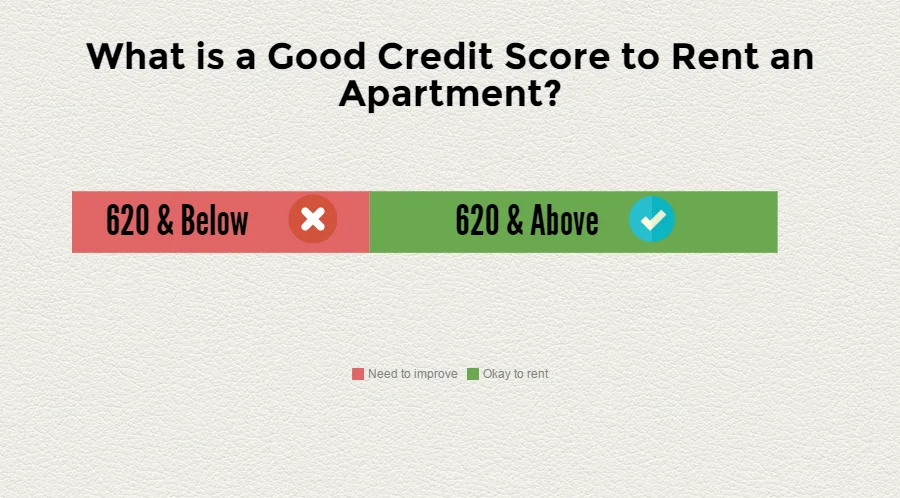

What credit score is needed to rent an apartment?

The majority of landlords will check your credit report to determine the risk of a new tenant prior to granting the lease. It is advisable to assess your financial situation at present, i.e., how you owe as compared to the income you earn. Also, you should look for any outstanding collections accounts, which could include the non-payment of rent due to an apartment previously rented.

In general, you’ll require an average credit score of at minimum 620 in order to qualify for the lease. If you don’t meet the minimum requirements, you’ll most likely require a cosigner for the rental contract. For instance, a person who has 615 credit scores would be in trouble however, if you have 635 or more, you’re probably to be in good shape.

In locations where rental property is highly sought-after You may also be required to pay a higher deposit. You might also need to pay the first and final month’s rent before the lease is approved when your credit scores are very low (below 600). In extreme circumstances you could be required to accept automatic payments that are taken directly from your bank account to be eligible.

What is a good credit score to purchase a car?

Car dealerships are famous for their “no credit, bad credit, any credit!” slogans to draw customers to purchase a brand new automobile.

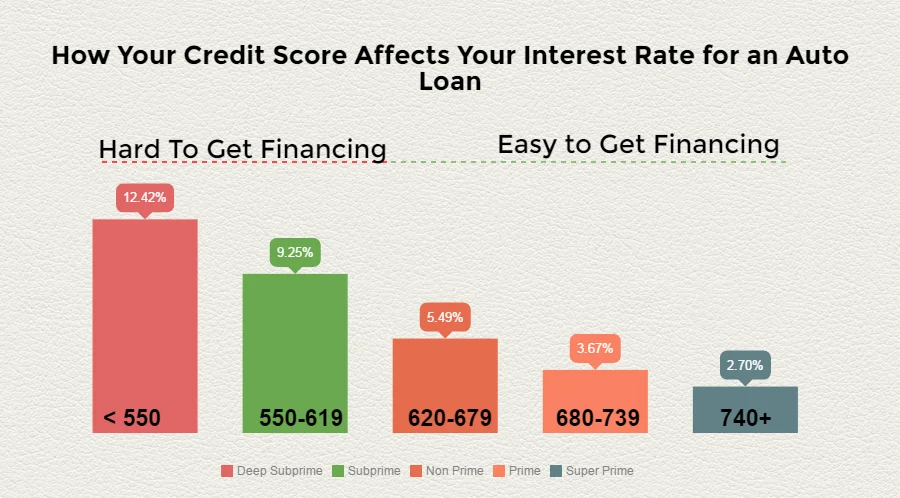

However, the best offers you see advertised on television are typically reserved for those with top-of-the-line “super-prime” credit ratings. A general overview of the interest rates of new car loans appears like this:

If your credit score falls in the subprime or deep subprime categories There is a chance that you won’t be able obtain financing in any way. However the interest rates could be higher if you do manage to obtain financing, as shown by the above list.

If you’re looking for the highest rates on a brand new vehicle, you should aim for an ‘excellent’ credit score of 680 or higher. If you’d like to be accepted for a car loan that has an acceptable rate, you should aim for an ‘fair’ credit score of at minimum 620.

What is a good credit score to purchase a house?

As mentioned previously, if you’re trying to buy a new house the mortgage company will be looking at your credit report. Many factors determine if you are eligible for a mortgage, and your credit score is just one of them.

In the end that if you’re looking to get a traditional mortgage you’ll need to have a credit score of minimum 640. The highest rates for mortgages are available to those with a credit score of 720 or higher.

Certain exceptions can be made for those who have FHA loans as well as VA loans. For instance, FHA loans only require 580 credit scores and VA loans do not require a minimum credit score required for mortgages.

However, these figures are misleading since neither the FHA or the VA actually offer loans. Instead, they guarantee loans to banks that actually do the lending – mostly providing the risk of mitigation in the event in the event of a default.

Even with the insurance coverage, you likely won’t be able to get an VA or FHA loan if you have credit scores that are lower than 620.

What is a good credit score for credit cards?

Credit cards are among the most diverse of the credit types you could be eligible for. If you’re looking for a fantastic interest rate, with no annual fee and a host of other benefits, you’ll need to have a 720 or higher. If you’re looking for a reliable credit card that has a great rate, you could be eligible for a good credit card if you have a credit score of 640.

If you have a poor credit rating or no history of credit, you usually aren’t eligible for credit cards with no collateral. However, you may be able to get an secured credit card which is a kind of credit card which requires the security of a collateral deposit.

There is usually no credit score, however it is a great way to improve or build credit scores by showing responsible borrowing behavior. The credit limit of secured credit cards is typically equal to the security deposit. In the event that the borrower fails to pay the issuer will make use of the deposit to pay the balance that is not paid.

How can I find out my credit score?

A lot of credit card companies provide Free FICO scores to their customers today. Some offer a credit score for free to non-customers. You may also buy your FICO score from FICO’s site, MyFICO. The VantageScore credit scores can be purchased on VantageScore’s site.

Be aware that certain banks and credit cards provide credit monitoring. However these credit scores might not match your FICO or VantageScore. Be sure to confirm the kind of credit score you’re receiving before you purchase it.

The only way to establish your credit score is by applying for credit or a loan. When you receive your acceptance (or refusal) letter you will generally get your credit score as well as how it influenced the decision to accept or decline your credit request.

This is the least-recommended method to improve your credit score, since there’s no way to boost your score prior to the time you are refused credit if you have issues.

How do I increase my credit score?

If your credit score isn’t at the level you want to be in order to be eligible for the types of credit you’re entitled to There are a variety of ways to improve your credit score with time.

- Be sure to pay your bills on time. Keeping current with your payments is the best method to improve your credit. Even a period of six months of timely payments can have a major impact on your credit score.

- Reduce your debt-to income ratio. The more debt you carry in relation to your income the less credit score you will have. Be sure to eliminate your credit card debts and pay off credit cards to provide yourself with breathing space.

- Pay down your credit cards. Your credit utilization ratio is a major factor. Utilizing all of your credit is a signal to lenders that you’re a high-risk borrower. So, you should pay off any balances until you use less than one-third of your credit limit.

- Remove any errors from your credit report. Any inaccurate negative items on your credit report could hinder your chances of being granted credit. This includes missed or late payment, charge-offs, collections accounts and many more. You can dispute any errors that you find in your credit report to each credit bureau or engage an experienced credit repair professional to do the work for you.

Knowing how to achieve an excellent credit score is a crucial first step towards taking charge of your finances. Remember that building credit histories takes time, and that you as an individual have rights to maintain the authenticity of your credit score.

Good Credit Scores FAQs

Why is it so important to have a great credit score?

A high credit score is crucial because it affects your ability to obtain loans as well as the conditions of loans you’re given. Banks, lenders as well as credit card companies utilize credit scores to assess the creditworthiness of prospective borrowers.

In addition to impacting your ability to get loans, a high credit score may also affect your ability to lease an apartment, obtain an employment offer, or obtain insurance.

A high credit score can provide financial opportunities and could reduce your expenses. To maintain and build an excellent credit score ensure that you pay your bills promptly, avoid over borrowing and manage your debts in a responsible manner.

What is a good credit score?

A high credit score is usually thought to be anything that is higher than 781. This is commonly called an “excellent credit score” in the world of finance.

What is the best credit score you can get?

The highest credit score you could get is one with a flawless credit score which is the FICO score of 85. It is important to keep in mind that an ideal credit score is not required to be able to get credit or loans and it’s extremely uncommon to achieve.

One Comment