When you apply for any type of credit, the lender look over your credit score and credit history before extending credit in order to determine if you’ll be capable of repaying them. If they find a charge-off accounts on your credit report this is the possibility of a red flag.

There are a variety of ways to get charge-offs taken off your credit report. We’ll first explain what is a charge-off and how it affects your credit score and if you’re required to pay or not.

What is a charge-off?

A charge-off usually happens after a period of time when you’ve non-payments on credit cards or another kind of debt. In general an item will be declared a charge-off if it’s more than 180 days in late. Simple, if it happens, the creditor marks the account as not not collectible.

Credit card issuers and lenders record bad debts as charge-offs primarily to satisfy tax purposes. They consider them tax write-offs or losses to reduce their tax burden.

While creditors view the item as an income tax loss however, they still believe that the debt will be paid in full.

If you’re a victim of a charge-off balance on your credit report, lenders may still pursue collection of the credit card. They typically employ an outside debt collection agency to collect the debt.

How long do charge-offs remain on your credit report?

Charge-offs are recorded on your credit report seven years after the time the account was debited.

Charge-offs can result in a dramatic reduction on your credit score. One charge in your credit report can result in you being denied credit cards or auto loans. This is because they are one of the most damaging things to show up in your credit report. However, it is possible to get rid of any charge-off prior to seven years have passed.

Can paying off a charge increase my credit score?

A charge-off with a payment is more favorable than an unpaid charge-off, and can have a positive impact on your credit score. However even a charged charge off is considered an imperfection and can negatively impact your credit score up to 7 years.

The direct effect on your credit score decreases over time, potential lenders can still see your credit score. This could negatively impact your chances of being approved for credit and competitive interest rates.

Additionally, there are a variety of consequences of settling an amount due to its age as well as other aspects. Be sure to consider the advantages and disadvantages of paying a charge-off prior to you decide.

When You Should Pay a Charge-Off

If the Charge-off is Recent

If the charge-off is new, you’re likely to experience a significant drop in your credit score. And the greater your credit score is, the more significant the dip. The reason is that a charge-off might just lower the credit score of 20 to 30 points in cases where you have a bad credit history. However, it could cause an average drop of 100 points for those with more credit scores!

This could mean the difference between qualifying at high rates or not being able to get certain kinds of loans.

If you can If you are able, arrange for payment to have the charge off removed from your credit record in full. This is usually simpler if the charge is new and you’re in contact with the credit card issuer’s or creditor’s in-house collection department.

To Qualify for a Home Loan

It is common for mortgage providers to demand that all outstanding debts be cleared prior to approval for loans. This includes delinquent payment as well as judgments, liens and charge-offs too.

If the charge-off is a long time ago it is possible to negotiate a partial settlement to settle the debt. But, you must always confirm with the lender whether it is possible to make a partial payment to meet their lending requirements.

If the Creditor Deletes/Re-ages It

Some creditors will take the charge-off off your credit report when you pay the full amount. However it isn’t the case for all creditors to be able to do that, and some say it’s not possible, however this isn’t the case.

You might have better chances of getting for them to “re-age” the account, however. In this scenario it would reset the timer on payments, and in essence your payment would appear like you had settled the account on time.

There are a variety of situations in which an off charge is the best option. They all depend on the assumption that the charge-off is yours and that you have verified that the amount is correct.

If you’ve confirmed that the debt isn’t yours or that the amount is incorrect it is advisable to seek help by a credit repair firm. Call them before committing to make the payment.

When You Should NOT Pay a Charge-off

If It’s Listed by Multiple Companies

It’s not uncommon for debts to be sold by a third-party collection agency and then re-sold to a different debt collector with minimal (if there is any) documentation. If you find multiple collection agencies that have the same account charged off it is important to have each collector check the debt prior to taking action.

The verification of who owns the account is a way to ensure you don’t pay a shady debt collector who is able to take the money, even if they no longer have the debt.

You Aren’t Sure You Owe the Amount Listed on the Charge-Off

Sometimes, collection agencies will attempt to add bogus charges and interests. If the contract you signed with the creditor you originally owed stipulates that a third party debt collector is able to add their own interest and fees however, they are not able to do this.

It’s also possible that you have paid the balance however, your account was marked as a charge-off due to an error within the system. If you have proof of the amount you paid you shouldn’t pay it.

Even if you don’t have proof, getting the debt confirmed could help you. A certified credit repair professional can advise you of the most effective way to proceed when you’re not sure of what to do.

It’s Past the Statute of Limitations

This last scenario differs between states because the laws regarding collection are different. If the charge-off is beyond the time limit and you are in a position to use the protection of a judgment imposed against you due to non-payment.

The problem is, you must appear in the court and defend yourself against any lawsuit filed by a collection agency.

The majority of debt collectors do not bother to file a lawsuit when your debt is beyond the time limit. Some people decide not to settle the debt, but rather let the charge-off disappear off their credit reports after seven years.

This will not help your credit score in the short-term however it could save your finances in the event that you are trying to pay down the balances on accounts that are currently open.

Can charged-off accounts be removed from my credit report?

Yes, there are several ways to remove charge-offs from your credit report before the credit reporting period of seven years.

Pay for Delete Agreement

One method to get rid of an account that has been charged off is to negotiate the “pay for delete” arrangement with the creditor who originally charged you. By using the pay for delete strategy you can get your lender to take the charge from your credit file in exchange for a payment. They may even agree to report the charge as “paid in full.” However this method is only effective for charge-offs that have not been paid.

A lot of times, creditors do not want to deal with this. It’s likely that they’ve already referred the debt to a collection company, however, sometimes they’re willing to bargain. While you may negotiate on via phone, it’s recommended to get the agreement written before making the money.

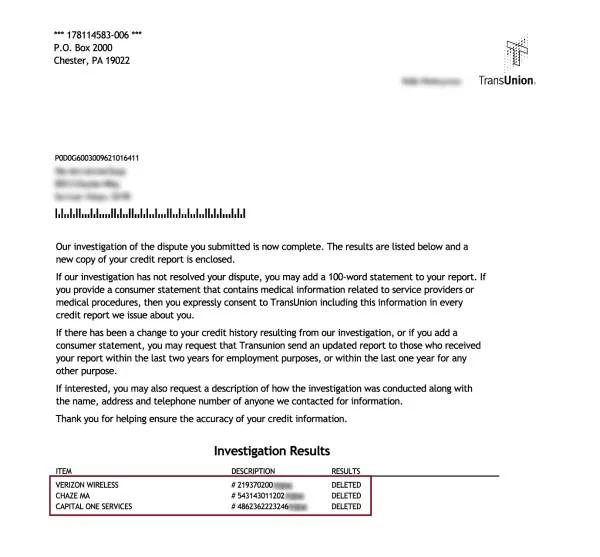

Dispute the Charge-Off

Another method of removing any charge-offs from your credit file is to dispute it with three credit bureaus: Equifax, Experian, and TransUnion. The law says that the Fair Credit Reporting Act (FCRA) permits you to dispute any item you believe to be untrustworthy. When the credit bureau has received an inquiry, they will contact your creditor and give the bureau 30 days to check the account.

If your creditor is unable to verify the account due to any reason, they have to erase the charge from your credit report. There are a variety of reasons why a lender will not or won’t confirm the charge-off account.

Under the FCRA the FCRA, you have the right to a free credit report for each of the major three bureaus each 12 months. When you’ve got your credit reports, it’s possible to are able to contest charge-offs by sending letters to credit bureaus. However, many prefer to work with a reputable credit repair service to take care of the tedious work because they have years of experience.

What is the most effective way to get rid of charge-offs from my credit history?

Removing a charge-off from your credit file could make the difference between being eligible for a loan to purchase an automobile or a house. Future lenders will want to verify that you have paid all of your outstanding debts. This is why the hiring of a credit repair business will make a big difference.

Credit repair services can help customers get rid of charge-offs from their credit report by disputing mistakes with credit bureaus on behalf of the clients. This means that you don’t need to reach out to any collection or credit bureau directly.

Credit repair companies also manage all the monitoring necessary to ensure that every collection agency or credit reporting agency is in compliance to the FCRA. Additionally, they ensure that your credit report doesn’t include errors such as account re-aging, or multiple listings for the same collection account.

Contact any of their credit repair experts about disputing charges on your credit reports If you’re not sure where to start. You can attempt this on your own, however you’re more likely to achieve success by getting professional assistance.

They will provide a free consultation to discuss how they can do in your specific situation.

Charge Offs Removed

If you’re dealing with poor credit and would like to know more, you can schedule a no-cost credit assessment with Credit Saint. They will dispute all types of negative items on your credit report including foreclosures, bankruptcies and repossessions, as well as charge-offs, collections, late payments and many more.

2 Comments