A collection or two accounts in your credit report could be a red flag when dealing with future lenders or credit card issuers.

While the process of removing a collection account from your credit history may be a challenge, it’s not impossible. The most effective way to start is to learn how collection accounts impact your credit score and how to deal with them.

How long does a collection account remain on your credit report?

Collection accounts can stay in your credit file for as long as seven years after the date that you defaulted on the initial account. Even if you pay fully, it’s considered a negative credit account and will remain on your credit report as a collection account for a period of up to seven years.

The collection account is different from the charge-off made by the creditor who originally made the charge, which could be visible on your credit report for a period of seven years.

How do collections affect your credit score?

The majority of accounts are put in collections after between 120 and 180 days over due. In this period the original creditor might stop contacting you regarding the account.

For many, an increase in collection activity can be an unpleasant surprise after their debts have been handed into third-party collection agencies who employ aggressive strategies.

Credit report collections can lower your score by 50 – 100 points the first time they show up. But, it all depends on the level of credit your score was prior to the initial appearance. The reason for this is that your payment history has the largest influence on your credit score.

In general the higher your credit score is, the less damaging the damage will be. In time collections accounts will affect your credit in a less significant way. Prior to your account being transferred to collections, you will receive a final notification from the initial creditor.

It is best the payment arrangement at this point so that you don’t suffer the same negative impact on your credit score.

Can paying off collections raise your credit score?

The past was when collections that were paid in your credit reports were viewed the same way as collections that were not paid. But, FICO is updating its credit score to exclude collections that are paid. Similar to that, VantageScore has recently updated its algorithm to deny paid collections of any kind.

With these updated versions of the credit scoring models that allow you to pay off collections accounts will improve your credit score. However it takes time for the new credit scoring models to be implemented by financial institutions. Therefore, it could take a while to see a positive result when you apply for credit.

FICO 9 & VantageScore 4.0

You can always ask prospective creditors about the credit scores they are using. If the score is FICO 9 or VantageScore 4.0 and above, you’ll be able to avail of the flexible calculation of paid collections.

It’s essential to be aware when you decide to settle a collection debt, even if you are still owed it.

Debt buyers are likely to collect on debts you aren’t legally obligated to pay Therefore, it’s essential to ensure that they verify the debt prior to you begin to take action. Also, be aware of your state’s statute of limitation that we’ll talk about in the coming days.

The FDCPA & State Collection Laws

You are entitled to rights under the Fair Debt Collection Practices Act (FDCPA) regarding timeframes and statutes of limitations, therefore it’s essential to be aware of them before you decide to act.

If you don’t, you may accidentally reset your clock for the collection account. So get ready to read up on all that you must know about how to get rid of collections accounts from credit report.

Debt Buyers

Sometimes known as “junk debt buyers,” collection agencies pursue old debts they’ve bought at pennies per dollar. They then report the accounts on your credit reports in order to convince you to pay them. Sometimes, they engage in unethical methods like buying debts have already been paid.

It’s not common for a third party collection company to purchase and then sell debts of the same type several times. This means you may have multiple collections accounts listed for the same debt. Each lowers your credit score more.

Knowing who holds the debt you owe at any moment can be a challenge. Even so, you’ll be required to negotiate with other collection agencies for debt who have a negative report on your credit report.

Debt Validation

The best method to start is to send an acknowledgement request to the debt collection agency, claiming that you have a debt to them. The first step is to ask the debt collector to stop any collection activity.

The debt collection company must verify the debt, and show that you indeed owe the debt. There’s no deadline that they must follow to send the information, however they cannot start any steps to collect the money until they have done so.

Reporting Limit vs. Statute of Limitations

You must be aware of two specific dates for collections accounts The limitation on reporting and the time limit.

Reporting Limit

The Fair Credit Reporting Act (FCRA) determines the reporting threshold on collections accounts and it is set at seven years from the date the last activity or DLA. The majority of accounts are discharged as bad debt following six months of non-payments. This means that you are likely to see your collections disappear off your credit report after seven years as well as six months following your last payment.

Statute of Limitations

The time limit for debt is different from state to state. It could be as short as three years or as long as six (or longer for certain kinds of debt). When the statute of limitation has expired on a debt, it’s called “time-barred.”

A debt collector will keep in touch with you until you request them to stop. However, they are not able to legally sue you to get a judgment after the deadline has passed. The debt could still be on your credit file even after the deadline has expired even if the reporting limit hasn’t yet been reached.

A shady debt collection agency could try to coerce you into making payments by putting a new date on your account. This is referred to as the practice of re-aging and is unlawful under the FDCPA and the FCRA.

If you attempt to create an installment plan, you may expose yourself to a lawsuit if you restart the time that creditors legally must collect. If you aren’t paying the person who is currently responsible for the account, it will remain as a collection account that is unpaid.

Medical Bills

Collectors of debt must wait 180 days before submitting unpaid medical bills to an agency for credit. It gives you an additional six months to get bills, make sure they are accurate and determine how you can deal with them before they show up on your credit reports.

Also, with the most recent version of the FICO score, FICO 9, medical collection accounts have less weight.

If you receive your billing information from your service providers Your first step is to verify that the information is correct. It isn’t always easy to figure out what the insurance company’s charges should cover and what charges you’ll be accountable for.

Explanation of Benefits

Examine the bill, and then compare it with the information on your Explanation of Benefits (EOB). If you’re unsure whether you’ve been charged appropriately contact your insurance company and ask for the information on your EOB and your bill sorted.

Once you’ve determined the exact amount owed, figure out how you’ll pay it. It’s better to contact the medical professional directly rather instead of ignoring bills and having them sent to an agency for collection.

You can enroll in monthly interest-free installments or request a reduction in costs. A balance forgiveness plan can help to keep your budget in check by making periodic payments or an all-in lump sum for a lower balance.

Can medical collections be removed from my credit report?

Yes. Like everything else in your credit report, you are able to take medical collections off of your credit report.

Spend the time to go over each detail related to the debt so that you have the best opportunity to have it canceled. When disputing medical accounts, you must follow the same guidelines as for any other collection account as described below.

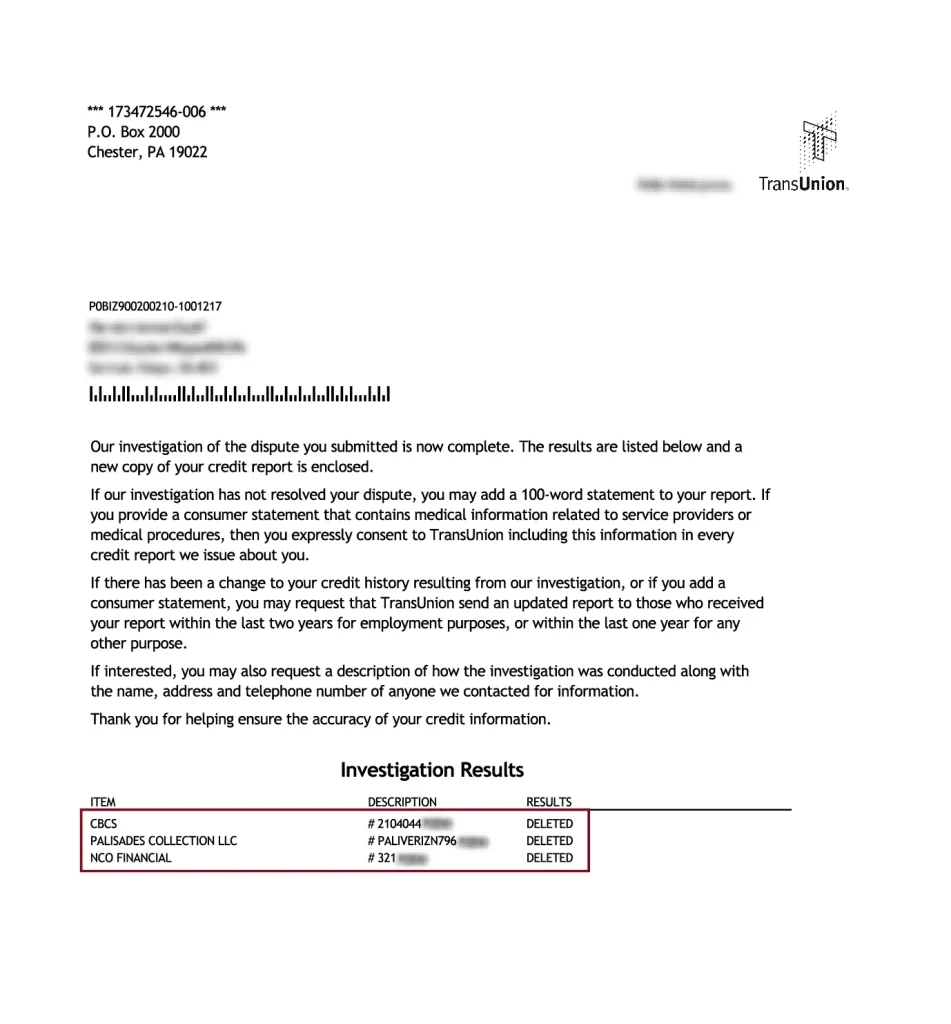

How to Remove Collections From Your Credit Report Without Paying

Here’s a real letter from one of the credit rating agencies that reported collections that they removed from the credit report:

Eliminating the collection account from your credit report could improve your credit scores considerably. It’s not uncommon to find that there are mistakes regarding collections accounts.

Obtain your free credit report from each of the three major credit bureaus at AnnualCreditReport.com and check it thoroughly. The reports get confused a lot since the buyers of debts pass their credit reports back and forth often.

Your collection accounts could have the incorrect balance, an incorrect date, or other mistakes that creditors aren’t able to correct. You might also see instances of late payment appearing in your credit report but were not actually late.

The debt collectors don’t care about how they affect your credit report. They’re only interested in making sure you pay and hoping that you don’t know that the law is in your favor!

Disputing Collections

You have the legal right to challenge false details in your credit report as per the Fair Credit Reporting Act (FCRA). This includes collections accounts with incorrect information, or any accounts you consider “questionable.”

The credit bureau has to investigate the dispute within 30 days. If the agency that collects your debt is unable to verify the collection account, it has to be removed from your credit file. Unfortunately some debt collectors don’t even bother to check. Additionally, some don’t have the paperwork to confirm the negative information in your credit report.

Pay for Delete

To completely eliminate collections from your credit score, you could also perform a ‘pay to delete. It is an agreement made between you and the debt collector to ensure that they will take it off your credit report after you have paid the collection account in full.

The most important thing is to have the agreement written. A contract over the phone will not stand up. Therefore, you need to convince the collector agree to the agreement.

Need help getting collections removed from your credit score?

This is the point at which using a credit repair firm can make a difference. They can help most people get rid of collections by disputing mistakes through three credit bureaus on behalf of you. This means that you don’t need to call any of the collection agencies or credit bureaus agencies on your own.

In addition, credit repair companies ensure that every collector agency as well as credit bureau is in compliance with the FCRA. They also make sure that your credit report is not contaminated by mistakes like account re-aging or multiple accounts for the same collections account.

Have your questions answered by one of their credit repair experts should you have any concerns about contesting collections. Of course, it’s possible to try it on your own, but you’re most likely to be more successful by getting help from a professional.

They provide a no-obligation consultation to explain how they can do to assist with your particular circumstance.